Four Key Objectives of a Sound Retirement Plan

A sound retirement plan should be based on your particular circumstances. No one strategy is suitable for everyone. Once you’re retired, your income plan should strive to address four basic objectives: earn a reasonable rate of return, manage the risk of loss, maintain a source of sustainable and predictable income, and reduce the impact of taxes.

Earn a Reasonable Rate of Return

Your retirement savings portfolio will likely be used to provide at least a portion of your income throughout retirement. The overall goal is to maintain an amount that produces the necessary income each year. This requires accounting for the rising costs of goods and services (including health-care expenses); identifying your budgetary needs and wants; estimating how long you’ll expect retirement to last; and factoring in Social Security and other income sources. It also requires estimating a rate of return you’ll need to earn on your portfolio and then putting together an investment strategy to pursue that target rate.

While we’d all like to achieve a 30%–40% annual return on our retirement savings, for most of us that isn’t practical. If you have enough savings to meet your retirement needs, you’ll want to maintain that level of savings throughout your retirement years. That’s why it’s important to strive for a realistic rate of return on those savings. Of course, determining a reasonable rate of return depends on your individual circumstances and goals.

Manage Risk of Loss

If you have sufficient savings to meet your retirement needs and goals, you’ll want to protect those savings and reduce the risk of loss due to sudden market corrections and volatility. The goal is to reduce investment risk and preserve savings. A reduction in savings due to a market downturn could require you to sacrifice important retirement goals and reduce retirement income.

Prior to retirement, you have more time to recover from market losses. However, once retired, your time frame for recovery is much shorter. For example, if you had retirement savings of $500,000 and lost 25% due to market volatility, your savings would be reduced to $375,000. You would have to earn a rate of return of more than 33% in order to get back to $500,000. That could take plenty of time to achieve.

Maintain a Sustainable and Predictable Income

During our working years, most of us are used to receiving a steady income. However, once we retire, the income we got from work is no longer there, even though that’s what we’ve been accustomed to. So it’s important to create a sustainable, dependable, income stream in retirement to replace the income we received during our working years. While you may receive Social Security retirement benefits, it’s unlikely that you can maintain your desired lifestyle in retirement on just Social Security. In addition, defined-benefit pension plans are not as prevalent or available as they once may have been. Most employers don’t offer pension plans, placing the burden on us to find our own sources of retirement income.

Maintaining a sustainable income in retirement is important for many reasons. You’ll want sufficient income to meet your retirement expenses. It is also important that your income is not negatively impacted by downturns in the market. And you’ll want your income to last as long as you do.

A Few Words About Retirement

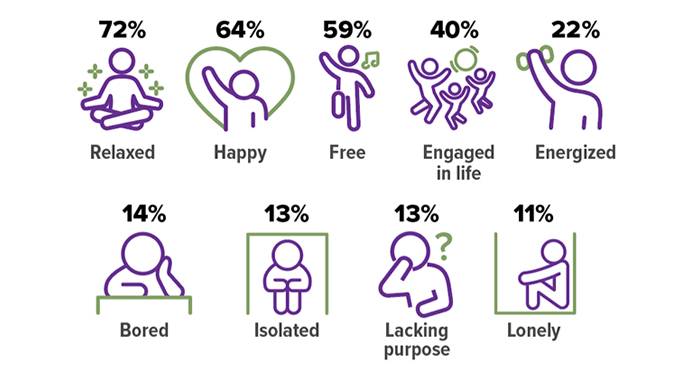

In a recent survey, retirees ages 40 to 74 were asked to choose from a list of words and short phrases to describe their feelings about retirement. The good news is that most had positive feelings.

Source: AARP, 2022 (multiple responses allowed)

Reduce the Impact of Taxes on Retirement Income

Taxes can cut into your retirement income if you don’t plan properly. Many of us think our tax rate will be lower in retirement compared to our working years, but that is often not the case. For instance, we may no longer have all of the tax deductions in retirement that we had while working. In addition, taxes may increase in the future, potentially taking a bigger chunk out of your retirement income. So it’s important to create a tax-efficient retirement.

Your retirement plan should be suited to your particular situation. However, these four objectives are often part of a sound retirement plan. A financial professional may be able to help you to earn a reasonable rate of return, manage risk of loss, create and maintain predictable retirement income, and reduce the impact of taxes on that income. There is no guarantee that working with a financial professional will improve investment results.