Child Care Is a Budget Buster: Take Advantage of These Tax Breaks

The U.S. Department of Health and Human Services considers child-care costs to be affordable when they are at or below 7% of annual household income — but many families face costs that are far above that threshold. In fact, about half of families surveyed by Care.com reported spending 20% or more of their household income on child care in 2021, while 72% of families spent at least 10%.1

The typical fees charged for child care vary widely by state, as do other living costs. But in all regions, the average annual cost of center-based care for two children exceeds the average amount of money families spend on food and transportation combined, and in most areas of the country, it is more expensive than housing.2

The following tax benefits can help parents offset some of the costs paid for a nanny, babysitter, day care, preschool, or day camp, but only if the services are used so the parents can work.

Child-Care Tax Credit

Families with one qualifying child (typically age 12 or younger) can claim up to $3,000 per year in child-care expenses; those with two or more qualifying children have a $6,000 annual limit.

The nonrefundable credit is worth 20% to 35% of eligible child-care expenses, depending on income. As income rises, the credit amount drops until it hits a minimum of 20% for households with $43,000 or more in adjusted gross income. For example, families with one qualifying child can receive a credit of $600 to $1,050; those with two or more children can receive a credit of $1,200 to $2,100. A tax credit lowers a family’s tax liability dollar for dollar.

Dependent-Care Flexible Spending Account

Higher-income families may realize a bigger tax benefit from a dependent-care flexible spending account (FSA) if one is offered by an employer, because up to $5,000 a year (per family) can be set aside on a pre-tax basis through regular payroll deductions. FSA distributions are free of federal income tax if the money in the account is used for eligible child-care costs for qualifying children. (Dependent-care FSA funds can also be used to cover care for children over age 13 with special needs and elderly parents or relatives that are claimed as dependents.)

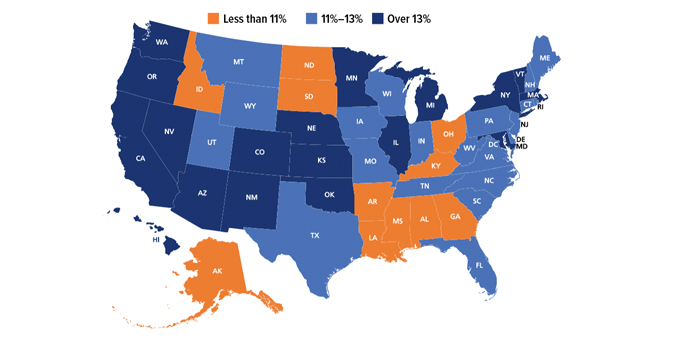

Child-Care Affordability Is All Over the Map

The annual price of center-based care as a percentage of median income, by state

Source: Child Care Aware® of America, 2022 (data for 2021; CO data for 2020)

Employees with access to an FSA as a workplace benefit generally have an opportunity to enroll in an account and elect contribution amounts during their annual open enrollment period. FSA funds that are not spent by the end of the calendar year could be lost, so it’s important to consider carefully — and at times reconsider — how much to put into the account. FSA owners are typically permitted to adjust their contributions when they experience certain events, such as a change in marital or employment status, a change in the number or eligibility of dependents, or a change in care provider or the rates charged for care.

Taxpayers are not allowed to use pre-tax money from an FSA and take a credit for the same expenses. However, after spending $5,000 from an FSA, families with more than one qualifying dependent could take a tax credit for up to $1,000 in additional care expenses.